Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Note

Community interest groups have now moved from Yammer to Microsoft Viva Engage. To join a Viva Engage community and take part in the latest discussions, fill out the Request access to Finance and Operations Viva Engage Community form and choose the community you want to join.

This article provides information to help you get started with Electronic invoicing for Belgium. It explains how to configure the system so that you can use the last-mile connector to generate, submit, and receive electronic invoices in the Pan-European Public Procurement Online (PEPPOL) format in Microsoft Dynamics 365 Finance.

Note

The electronic invoicing approach that this article describes is implemented by using an invoicing service that's applicable only to cloud deployments of Dynamics 365 Finance.

Watch the following overview of the Belgian electronic invoicing implementation in Finance.

Prerequisites

Before you begin the procedures in this article, meet the following prerequisites:

The company must be a registered taxpayer in Belgium.

The company must have a signed agreement with the provider of electronic document delivery service that secures electronic document interchange in the PEPPOL format.

Among the registered profile IDs, the company should have the urn:fdc:peppol.eu:2017:poacc:billing:01:1.0 profile. Finance uses this profile for the interchange of documents in the PEPPOL format.

The company must obtain, from the service provider, the required credentials to enable integration of the Electronic Invoicing service with the Electronic Invoicing service independent software vendor (ISV) last-mile connector.

Note

The current implementation assumes Edicom as the Electronic Invoicing ISV last-mile connection service provider. Learn more in e-Invoicing Integration with Microsoft Dynamics 365.

Become familiar with Electronic invoicing as it's described in Electronic Invoicing service overview and Electronic invoicing components.

Complete the common part of Electronic Invoicing service configuration as described in Electronic invoicing components.

Create the Azure Key Vault configuration

Create an Azure key vault to store the required secrets that are issued for your company. Learn more in Configure Azure resources for Electronic invoicing.

In the key vault, add the secret for the token that grants authorization to access the Edicom services. You must obtain this token from Edicom before you begin, as described in the prerequisites.

Configure electronic invoicing Key Vault parameters

To configure electronic invoicing Key Vault parameters, follow these steps.

Go to Organization administration > Setup > Electronic document parameters.

On the Electronic invoicing tab, in the Key Vault settings section, in the Key Vault field, select the reference to the key vault that you created in the previous section of this article.

In the SAS token secret field, select the name of the storage account secret URL that you use to authenticate access to the storage account.

Select Key Vault parameters.

On the Key Vault parameters page, in the Certificates section, select Add to create a token element of the Secret type for the secret that is described in the previous section.

Note

The value in the Name column should match the name of the secret that is described in the previous section.

Import the electronic invoicing feature

Go to Globalization Studio, and select the Electronic invoicing tile. Then import the latest version (5 or later) of the Belgian electronic invoice (BE) Globalization feature as described in Import features from the repository.

In the Electronic reporting workspace, on the Reporting configurations tile, make sure that the following Electronic reporting (ER) configurations are successfully imported when you import the Belgian electronic invoice (BE) Globalization feature:

- Invoice model

- Invoice model mapping

- PEPPOL Sales e-invoice

- PEPPOL Sales e-credit note

- PEPPOL Project e-invoice

- PEPPOL Project e-credit note

- Customer invoice context model

- Response message model

- Edicom Response Processing

- Error log import Json

Note

If the preceding ER configurations aren't imported for some reason, manually import them as described in Import Electronic reporting (ER) configurations from Dataverse.

On the Reporting configurations tile, import the latest versions of the following ER configurations. These configurations are required for the receipt of incoming vendor invoices.

- Vendor invoice import

- Vendor invoice Mapping to destination

- Import invoice context model

Configure the electronic invoicing feature

The Belgian electronic invoice (BE) electronic invoicing feature includes some parameters with default values. Before you deploy the electronic invoicing feature to the service, review the default values, and update them as needed to better reflect your business operations.

To review and update the configuration of the Belgian electronic invoice (BE) electronic invoicing feature, follow these steps.

Go to Globalization Studio, and select the Electronic invoicing tile. Then import the Belgian electronic invoice (BE) Globalization feature as described in Import features from the repository.

Create a copy of the imported Globalization feature, and select your configuration provider for it, as described in Create Globalization features.

On the Versions tab, verify that the Draft version is selected.

On the Feature parameters tab, specify values for the following connection and integration parameters. These parameters are required for interoperation with Edicom services.

- Service ID – Enter the service ID (domain) number that you obtained from Edicom. This value is used for company identification.

- Group – Enter the group code. This value is used for internal routing within the Edicom infrastructure.

- Destination – Enter the destination, which you construct by concatenating the service ID number and the string _EDIWIN. For example, if the service ID number is 123456, enter 123456_EDIWIN.

- Token – Select the name of the token that you previously created.

The copy of the feature is always created as a Draft version. Complete and deploy the feature as described in Complete and deploy a Globalization feature.

Configure electronic document parameters

Go to Organization administration > Setup > Electronic document parameters.

On the Electronic document tab, add records for the Customer Invoice journal and Project invoice table names.

For each table name, set the Document context and Electronic document model mapping fields in accordance with Set up Electronic document parameters.

Note

If you create derived analogs of the previously mentioned ER configurations, use them instead of the standard ones.

On the Integration channels tab, in the Channels section, select Add to create a channel.

In the Channel field, enter EdiStatus. Enter the value exactly as it appears here. The system uses this channel to submit outgoing electronic invoices.

In the Company field, select a required legal entity.

In the Document context field, select the Data channel context mapping from the Customer invoice context model configuration.

In the Channel type field, select Export.

In the Channels section, select Add to create another channel.

In the Channel field, enter EdiImport. Enter the value exactly as it appears here. The system uses this channel to import incoming electronic invoices.

In the Company field, select a required legal entity.

In the Document context field, select the Data channel context mapping from the Import invoice context model configuration.

In the Channel type field, select Import.

In the Import sources section, select Add to create an import source.

In the Name field, enter ResponseXml. Enter the value exactly as it appears here.

In the Data entity name field, select the Vendor invoice header entity.

In the Model mapping field, select the Import vendor invoice mapping from the Vendor invoice import configuration.

Select Save, and close the page.

Note

If you must use other integration channels besides EdiStatus and EdiImport, you must do extra configuration of the feature and context.

Configure the address structure

To configure the structure of the postal address and define all required elements, follow these steps.

Go to Organization administration > Global address book > Addresses > Address setup.

Make sure that at least the following mandatory elements are configured:

- Country/region code

- Postal code

- City name

- Street

Configure legal entity data

Enter the address

To enter the address, follow these steps.

- Go to Organization administration > Organizations > Legal entities.

- Select a legal entity.

- On the Addresses FastTab, add a valid primary address for the selected legal entity.

Verify the seller's identification

To identify a company by its value-added tax (VAT) number, follow these steps.

Go to Organization administration > Organizations > Legal entities.

On the Foreign trade and statistics FastTab, in the INTRASTAT section, in the VAT exempt number export field, make sure that a valid VAT number is entered for the legal entity.

The VAT number is entered in the Invoice\cac:AccountingSupplierParty\cac:Party\cbc:EndpointID element in the electronic invoice XML file that is generated. You use it as the seller's identification during the submission process.

Note

The contact information for the legal entity is automatically retrieved from the related Person record that is associated with the current user in Finance.

Configure customer data

Enter the address

To enter the address, follow these steps.

- Go to Accounts receivable > Customers > All customers.

- Select a customer.

- On the Addresses FastTab, add a valid address for the selected customer.

Enter the contact person

To enter the contact person, follow these steps.

Go to Accounts receivable > Customers > All customers.

Select a customer.

On the Sales demographics FastTab, in the Primary contact field, select the person who is considered as the buyer's contact.

Note

You must already define all available contact persons for the selected customer. Make sure that the selected contact person has a valid email address and phone number.

Verify the buyer's identification

The buyer's EndpointID determination uses the following hierarchy of built-in Registration numbers.

If you define the Global Location Number (GLN), also known as a European article numbering (EAN), for the customer as an active Registration Number with the EAN Registration category, the system uses it as the customer's EndpointID and uses the 0088 constant (EAN Location Code) as the EndpointID schemeID attribute's value.

If you don't define the EAN registration number, the system uses the customer's active Registration Number of the Enterprise ID Registration category as the customer's EndpointID and uses the 0208 constant (Numero d'entreprise / ondernemingsnummer / Unternehmensnummer) as the EndpointID schemeID attribute's value.

If you don't define the EAN and Enterprise ID registration numbers, the system uses the customer's active Registration Number of the VAT ID Registration category as the customer's EndpointID and uses the 9925 constant (Belgium VAT number) as the EndpointID schemeID attribute's value.

If you don't define the VAT ID registration number, the system uses the Tax exempt number defined in customer's master data as the customer's EndpointID and uses the 9925 constant as the EndpointID schemeID attribute's value.

The resulting Endpoint ID value populates the Invoice\cac:AccountingCustomerParty\cac:Party\cbc:EndpointID element in the generated electronic invoice XML file and is used as the buyer's identification during the submission process.

Note

If the built-in registration numbers aren't sufficient, you can redefine the default schema by following the configuration steps for the Buyer identification in the next section. You can define any schema from the list of allowed values Electronic Address Scheme (EAS). Otherwise, skip ahead to the Configure units of measure section.

Configure identification schemas

Follow the configuration steps in this section only if you need to redefine the default identification schemas for sellers and buyers.

Configure electronic document properties

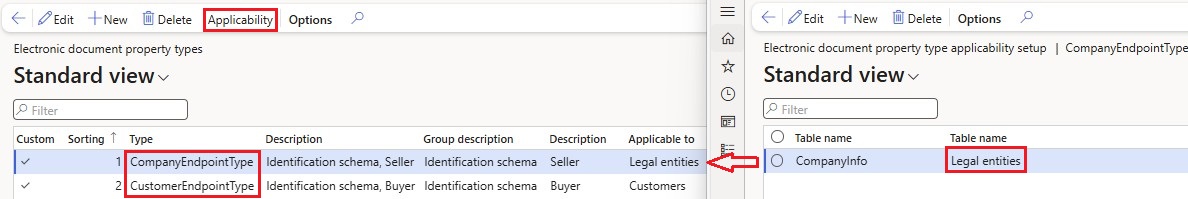

To configure electronic document properties, follow these steps.

- Go to Accounts receivable > Setup > Electronic document property types, and select New.

- In the Type field, enter CompanyEndpointType. Enter the value exactly as it appears here. This value is used for the Seller identification schema definition.

- Select Applicability to add an applicable table.

- On the Electronic document property type applicability setup page, in the Table name field, select the Legal entities table name.

- Save your changes, and return to the Electronic document property types page.

- Select New to create another electronic document property type.

- In the Type field, enter CustomerEndpointType. Enter the value exactly as it appears here. This value is used for the Buyer identification schema definition.

- Select Applicability to add an applicable table.

- On the Electronic document property type applicability setup page, in the Table name field, select the Customers table name.

- Save your changes, and return to the Electronic document property types page.

- Save your changes, and close the page.

Enter the Seller schema code

To enter the Seller schema code, follow these steps.

- Go to Organization administration > Organizations > Legal entities.

- Select a legal entity then on the Action Pane, select Electronic document properties.

- In the Value column, enter the required Seller schema code.

Note

For the seller's identification, schema 9925 (Belgium VAT number) is used by default if you don't define another schema. Schema codes that you define through electronic document property types take priority over the default 9925 schema code. The value of the EndpointID is always retrieved from the seller's VAT exempt number export field regardless of the schema value redefined in the seller's CompanyEndpointType parameter.

Enter the Buyer schema codes

To enter the Buyer schema codes, follow these steps.

- Go to Accounts receivable > Customers > All customers.

- Select a specific customer in the list then on the Action Pane, on the Customer tab, in the Properties group, select Electronic document properties.

- In the Value column, enter the required Buyer schema code.

Note

For the buyer's identification, schema 9925 (Belgium VAT number) is used by default if you don't define another schema. Schema codes that you define through electronic document property types take priority over the other built-in 0088, 0208, or 9925 schema codes. The value of the EndpointID is retrieved from the buyer's active registration number, which you must create with the type that exactly matches the value of the buyer's CustomerEndpointType parameter.

Configure units of measure

To configure units of measure, follow these steps.

Go to Organization administration > Setup > Units > Units.

Select a unit ID, then select External codes.

On the External codes page, in the Overview section, in the Code column, enter a code that matches the selected unit ID.

In the Standard code column, select the checkbox.

In the Value section, in the Value field, enter the external code according to the required codification.

Note

For scenarios where no specific units of measure are assumed, the default value EA is used.

Configure sales tax codes

- Go to Tax > Indirect taxes > Sales tax > Sales tax codes.

- Select a sales tax code then on the Action Pane, on the Sales tax code tab, in the Sales tax code group, select External codes.

- In the Overview section, create a line for the selected unit. In the External code field, enter the sales tax code you selected in step 2.

- In the Value section, in the Value field, enter an external code to use for the selected sales tax code, according to Duty or tax or fee category code (Subset of UNCL5305).

Buyer reference

According to PEPPOL requirements, when you register free text invoices, invoices that are based on sales orders, or project invoices, you must enter either a customer reference or a customer requisition.

Free text invoices

- Go to Accounts receivable > Invoices > All free text invoices.

- Create a new invoice, or select an existing invoice.

- In the Header view, on the Customer FastTab, in the References section, enter values in the Customer requisition and/or Customer reference fields.

Sales orders

- Go to Accounts receivable > Orders > All sales orders.

- Create a new sales order, or select an existing sales order.

- In the Header view, on the General FastTab, in the References section, enter values in the Customer requisition and/or Customer reference fields.

Project invoices

Go to Project management and accounting > Projects > Project contracts.

Create a new project contract, or select an existing project contract.

On the Funding sources FastTab, select or create a funding source of the Customer type, and then select Details.

On the Funding source details page, on the Other FastTab, in the References section, enter default values for the contract in the Customer requisition and/or Customer reference fields. Alternatively, you can enter project-specific values in the corresponding fields on the E-invoice FastTab.

To enter customer requisition and/or reference values directly on the project invoice proposal, follow these steps:

- Go to Project management and accounting > Projects invoices > Project invoice proposals.

- Create a new invoice proposal, or select an existing invoice proposal.

- On the Invoice proposal header FastTab, in the e-Invoice section, enter values in the Customer requisition and Customer reference fields.

Issue electronic invoices

After you complete all the required configuration steps, you can generate and submit electronic invoices for posted invoices by going to Organization administration > Periodic > Electronic documents > Submit electronic documents. Learn more about how to generate electronic invoices in Submit electronic documents.

Important

In current implementations, the standard submission procedure that was described earlier only generates electronic invoices and stores them on the service side. The procedure doesn't submit the invoices. To submit electronic invoices, you need to complete the following additional steps.

To submit the generated electronic invoices, follow these steps.

- Go to Organization administration > Periodic > Electronic documents > Run submission process in export channels.

- In the Channel field, select the export channel that you previously created. Then select OK.

You can check the results of the submission by going to Organization administration > Periodic > Electronic documents > Electronic document submission log. Learn more in Work with Electronic document submission log.

Note

Submitted electronic invoices are also available in the Outbound folder and its subfolders in your Ediwin portal. There, you can monitor further processing of the documents.

Receive incoming electronic invoices

Before you can import incoming invoices, you must configure some other parameters directly in Finance.

You must configure the following types of master data to provide a match for incoming electronic invoices:

- Vendors

- Products

- Units

Follow the configuration steps in Import vendor electronic invoices. Start from the Configure vendor data section.

Receive electronic invoices

After you complete all the required configuration steps, you can receive incoming electronic invoices in the PEPPOL format.

Note

You can review incoming electronic invoices in the Inbound folder and its subfolders in your Ediwin portal.

To receive electronic invoices, follow these steps.

- Go to Organization administration > Periodic > Electronic documents > Receive electronic documents.

- Select OK, and then close the page.

To view the receipt logs for processed electronic invoices, go to Organization administration > Periodic > Electronic documents > Electronic document receipt log.

To view successfully received invoices, go to Accounts payable > Invoices > Pending vendor invoices.